What is a memecoin? — This cultural symbol originating from the crypto community has now become a core weapon for perpetual contract trading platforms (Perp DEX) to compete for users and activate their ecosystems. During the turbulent period of the crypto market in 2025, Perp DEX, which had not yet issued its own token, achieved growth against the trend by issuing the community memecoin, while platforms that had already issued tokens deepened user stickiness through the memecoin ecosystem.

What is MEME coin? From marginal culture to the core of the ecosystem

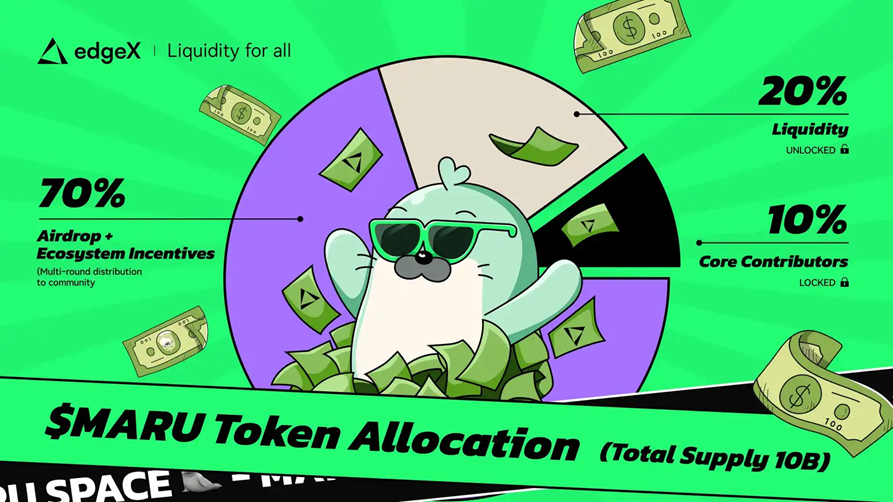

Memecoins, or cryptocurrencies issued based on internet cultural symbols, community memes, or trending events, are essentially a monetized expression of community consensus. In the Perp DEX arena, meme coins are no longer limited to short-term speculation but have become a strategic weapon for the platform’s ecosystem. Take EdgeX’s MARU as an example; this memecoin, modeled after the platform’s seal mascot, has a total supply of 10 billion, or 70 MARU. This “transaction mining” points system makes $MARU a bridge connecting platform activity and user rewards.

However, the POPCAT manipulation incident encountered by Hyperliquid exposed another side of meme coins: as a highly volatile asset, it can attract speculative funds but can also become a tool for attackers. On November 12, 2025, attackers used 3 million USDC leverage to go long on POPCAT, creating a false buying frenzy to induce others to follow suit, ultimately resulting in $25.5 million in long liquidations and $4.9 million in bad debts for the platform. This incident confirms the dual nature of meme coins in Perp DEX: they are both a traffic entry point and a risk amplifier.

The memecoin ecosystem: The “three pillars” of Perp DEX

In the Perp DEX sector, memecoin’s operation has formed a standardized template, represented by three major platforms: edgeX, Lighter, and Aster, giving rise to three typical models.

1. Community-Driven: EdgeX’s MARU experiment. edgeX has built a three-in-one ecosystem of “trading-content-community” through MARU. Its points system includes four weighted dimensions: perpetual contract trading (60%), referral rewards (20%), liquidity provision (10%), and position liquidation (10%). More innovative is the “Creator Activity”—users who create original content such as tweets, videos, and memes and tag @edgeX_exchange can share a prize pool of 500,000 USDT + 20 million MARU after official selection. AI-generated content is explicitly excluded, and multiple languages (Chinese, English, Korean, and Japanese) are supported. This design binds content creation with economic incentives, making memecoin a carrier of community consensus.

2. Capital-Driven Growth: Lighter’s Valuation Myth

Lighter completed a $68 million funding round at a $1.5 billion valuation, led by Founders Fund and Ribbit Capital, with rare participation from brokerage VC Robinhood. Its daily trading volume once exceeded $11.2 billion, and its TVL increased 2000-fold to $1.15 billion in six months. Memecoin played a key role in this growth: the platform incentivized trading by issuing $LIGHTER tokens and integrated Chainlink oracles to support RWA derivatives, expanding memecoin from a speculative asset into an ecosystem infrastructure. However, analysts pointed out that its trading volume/open interest ratio once reached 27 (a healthy value should be ≤5), suggesting the existence of point-incentive-driven wash trading.

3. Mechanism Innovation: Aster’s “Liquidation Consolation Prize”

Aster’s “Machi Mode” feature allowed liquidated users to receive point rewards, a design directly mocking “Liquidation King” Machi Big Brother (Huang Licheng). This feature transforms memecoin from a “loss token” into a “risk hedging tool”—users can receive compensation through points even if they incur losses, enhancing platform stickiness. Combined with the fourth phase “Aster Harvest” airdrop of 120 million ASTER (representing 1.5% of the total supply) and the $10 million trading competition’s “double-win” mechanism (the same transaction is counted in both the competition and the airdrop), Aster has built a closed-loop ecosystem of “trading-airdrop-buyback.”

The Hidden Concerns and Future of Memecoin

Despite memecoin’s strong performance on the Perp DEX, its potential risks cannot be ignored. For example, Aster has 6.35 billion tokens locked, with $700 million worth of tokens to be unlocked by 2026, potentially triggering selling pressure. The Hyperliquid POPCAT incident further exposed the fatal risks of combining leveraged trading with memecoin—attackers could manipulate prices to trigger a chain of liquidations, leading to bad debts on the platform.

However, the industry is still exploring solutions. EdgeX’s EdgeXFlow modular execution layer, with its 200,000 orders per second processing capacity, <10 ms latency, and ZK proof transparency, attempts to build a safer memecoin trading environment. Its XPIN campaign in partnership with Ave.ai uses a hybrid incentive model (tiered airdrops based on trading volume + leaderboard rewards + 1.1x points bonus) to both control wash trading and expand user reach. Pacifica’s innovative TIF=TOB order type solves the problem of market makers penetrating the order book by automatically adjusting limit orders to the top, providing better liquidity for memecoin trading.

In the Perp DEX arena, memecoin has evolved into a synonym for ecosystem strategy: it serves as a bridge connecting the community and trading on EdgeX, a lever for Lighter to attract capital, and a key to activating user participation on Aster. This branding has elevated memecoin from a “meme culture” to an “ecosystem language,” becoming a core identifier for platform differentiation.

What is a memecoin? It is the cultural DNA of the crypto community, the traffic engine of Perp DEX, and a tool for capturing ecosystem value. During the market turmoil of 2025, memecoin demonstrated its vitality with real data: EdgeX’s $MARU airdrop attracted over 13,000 addresses, Lighter’s daily trading volume exceeded 10 billion, and Aster’s buyback amount reached $214 million. However, amidst the frenzy, the industry needs to be wary of risks such as leverage manipulation and token unlocking. Only through technological innovation (such as EdgeXFlow), mechanism optimization (such as Machi Mode), and ecosystem governance (such as anti-scalping measures) can memecoin truly become a sustainable ecosystem asset.

As Perp DEX experiences a surge in TGE transactions in December, will the memecoin frenzy replicate the phenomenal performance of Aster’s launch? The answer may lie in each platform’s differentiated interpretation of memecoin—it is a risk amplifier, a testing ground for innovation, and a monetized expression of community consensus. In this perpetual contract meme revolution, memecoin is writing its own narrative of the times.